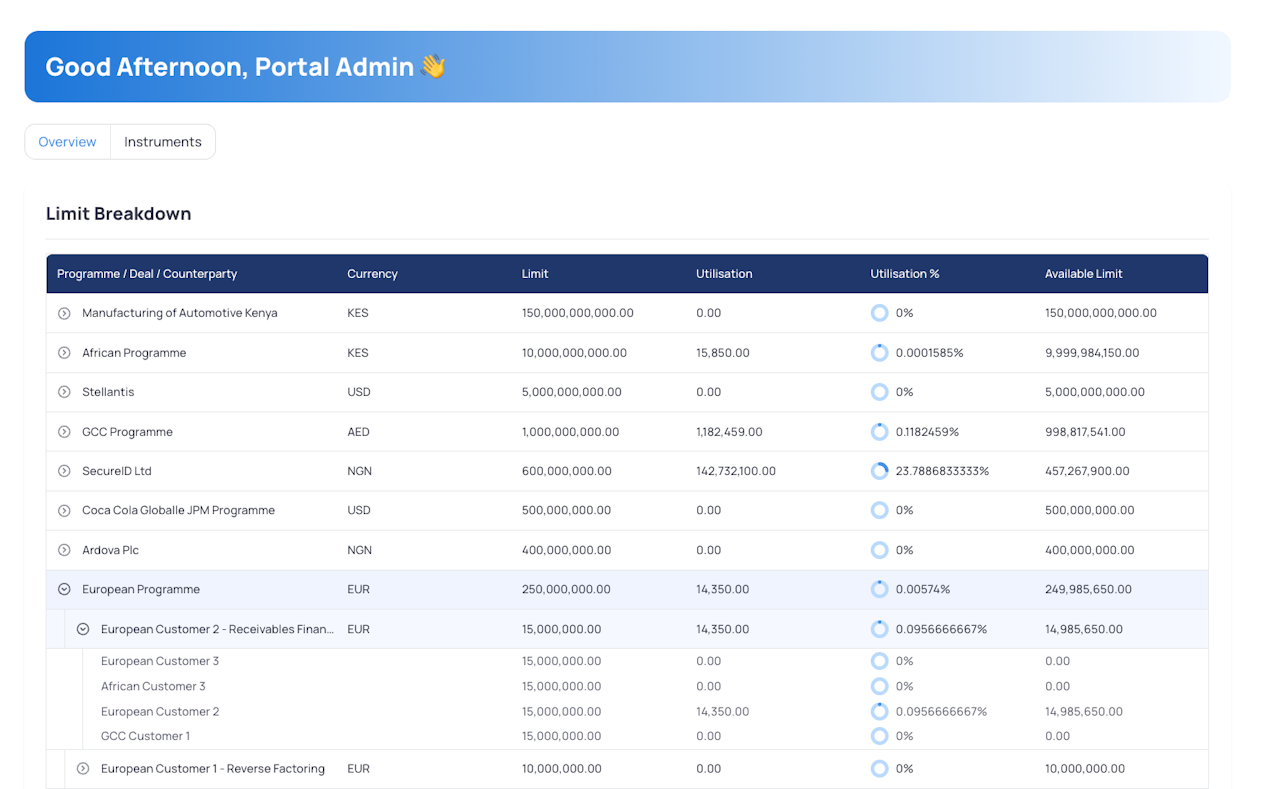

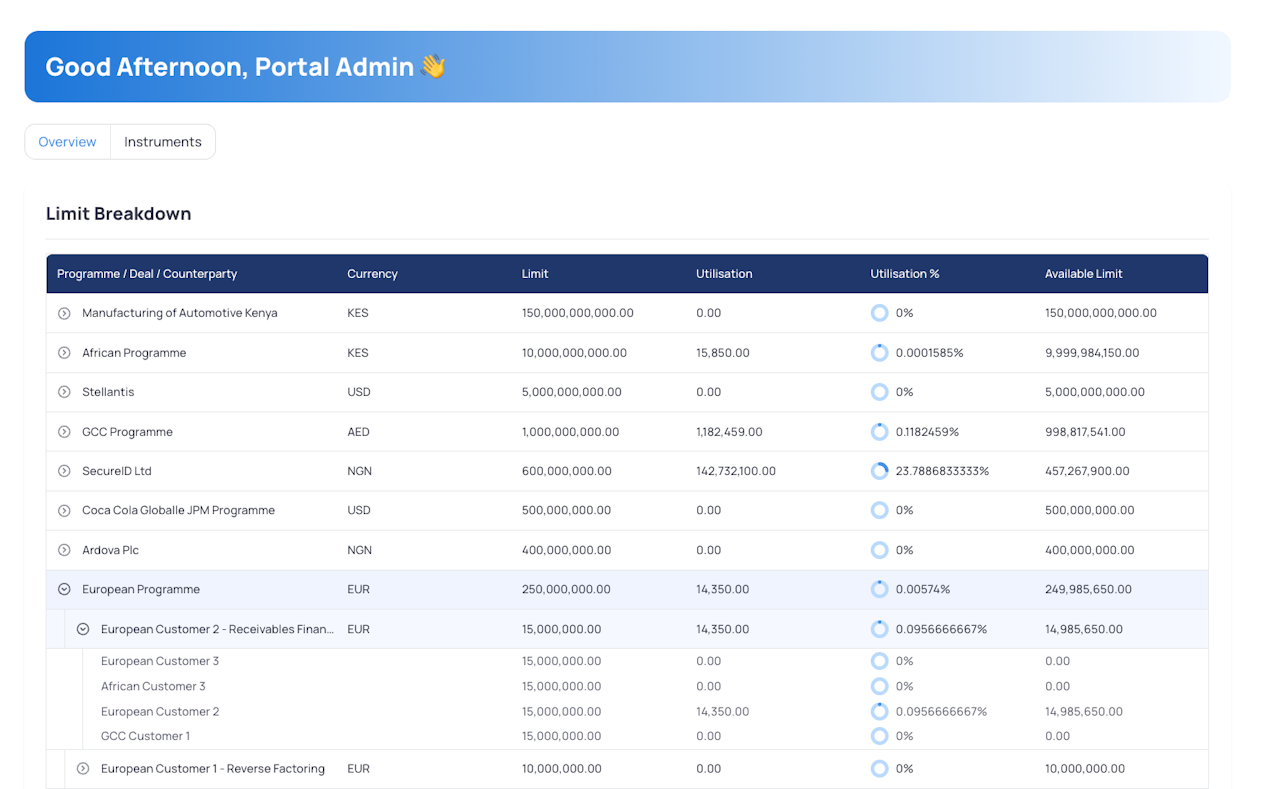

Limits on FinverityOS

FinverityOS offers three layers of Limits set up for a single Transaction/Deal:

Programme Limit – This is the global limit assigned to a corporate client (or group of clients). At this stage, the limit is not yet allocated to specific financial products.

Deal Limit – The limit of the specific facility that is being created. This is where we define the strucure for the facility, e.g: Recievables Finance without recourse. Multiple Deals can exist within the same programme.

Counterparty Limit: The maximum limit for each counterparty registered under the deal limit expressed as either a Concentration % or a flat value.

These layered limits work together to manage risk at different levels, from the overall programme to individual deals and specific counterparties.

1. Global Limit

The global limit is the highest-level restriction set during the creation of an investment program. It represents the maximum amount that can be allocated across multiple deals within the entire program. This overarching limit ensures that the total exposure of the investment program does not exceed a predefined threshold, thereby managing overall risk.

2. Deal Limit

A deal limit is a secondary layer under the global limit, specifying the maximum amount that can be invested in an individual deal. Several deal limits collectively fall under the global limit. This allows for diversified investments while ensuring that no single deal consumes too large a portion of the overall program's funds. Deal limits help in managing the risk associated with each individual investment.

3. Counterparty Limit

The counterparty limit is the most granular level of restriction, determining the maximum amount that can be invested in a specific company or entity. This limit ensures that the exposure to any single counterparty remains within acceptable bounds. Multiple counterparty limits exist under each deal limit, providing detailed control over the distribution of investments.